January 1, 2024

Dear Fellow Investors,

We’ve outlined the major topics & takeaways of our annual letter below – details follow!

MAIN MESSAGE HIGHLIGHTS:

- The pace of society, growth in output, and improvement in living standards has boomed since the Industrial Revolution

- Efficient production unlocked new abilities for the masses like the concepts of disposable income, leisure time, and retirement

- We believe we’re in the midst of the “Intelligence Revolution”, where Moore’s Law is overtaken by Huang’s Law as the governing factor for the pace of advancement

- Language as an operating system, renewable and abundant low-cost energy, the birth of a Space Economy, and Engineered Biology are a few examples of an exciting future

- The “Intelligence Revolution” allows for parabolic productivity gains, opportunities for significant wealth creation, a continued surge in living standards, and more time to be human

FORECASTS FOR 2024

- Economy: GDP up better than 3%, eclipsing $28.5 trillion – sluggish but no recession!

- S&P 500: a market driven by earnings growth ending in a range of 4,700 to 5,200

- Short-term rates: no change with the first possible cut coming after the election

- Long-term rates: 10-year yield drifts up to 4.5%

- Oil prices: maintaining a range of $70 - $100/barrel and an average in the $80s

- Inflation: in the range of 3.0% - 3.5%

- Commercial real estate: FTSE NAREIT All Equity total return index finishing at 10% or higher

- Residential real estate: muted gains rising less than 5%

“Fun” forecasts

- There will be a major merger in the entertainment industry

- AGI will be accepted as being here and ASI will be the talk of regulatory debate

Long-term forecasts

- identifying trends that will command positive attention

- A working quantum computer will become reality facilitating a jump to ASI

- Humanity breaks ground on a permanent moon-base

- Blake’s Tesla will earn money for him as he enrolls in their autonomous ride-hail service

Dear Fellow Investors,

In general, people are ultra-focused on one-year time frames. We have annual reviews at work, celebrate birthdays, anniversaries, progressing through grades in school, and annual sporting events like the upcoming Super Bowl. It makes sense considering the 365-day calendar we’ve been using since the times of Julius Caesar. Annual traditions are common and engrained in our lives. However, when it comes to investing, viewing progress through a one-year lens is often times insignificant and can lead to investors not being able to “see the forest through the trees”.

Background

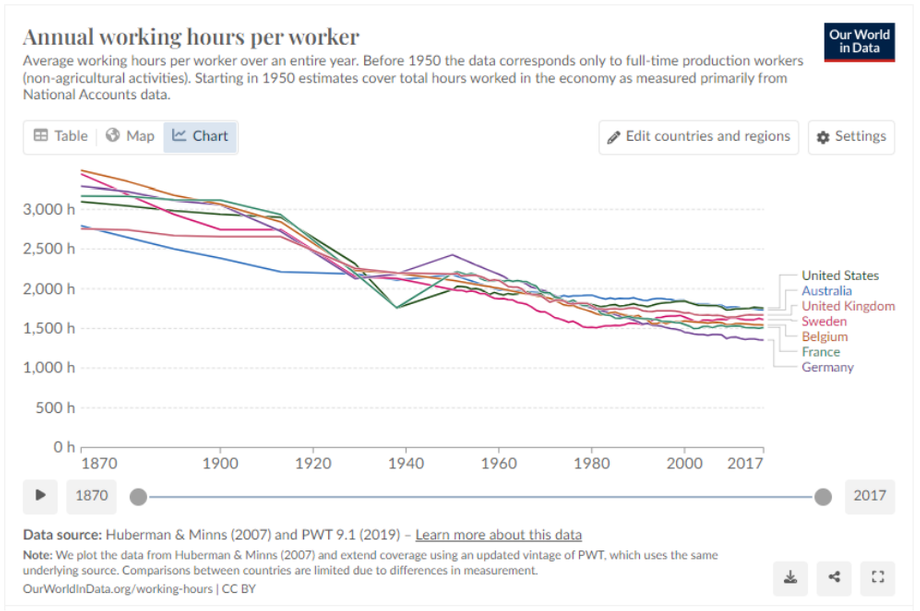

We have been living through a miraculous period of time over the past two-hundred years. There has never been a period with a greater improvement in living standards. What we’ve come to expect as the status quo, that future generations will enjoy a better life than previous generations, is a relatively new concept. Do a little digging and you’ll find study after study showing very little change in living standards over numerous centuries. The parabolic growth in economic output, corresponding wealth creation, and increase in living standards is something we’ve grown accustomed to and largely traces its roots to the Industrial Revolution.

Source: https://ourworldindata.org/grapher/world-gdp-over-the-last-two-millennia

Some question how we could possibly know historic economic output without the use of today’s sophisticated measurement tools. But that’s the thing, you don’t need sophisticated tools to measure economic output when output is largely agrarian. We can derive a very good estimate of output merely knowing how much land one farmer was capable of working, what crops were grown, and the yield from those crops. This isn’t to say there wasn’t tremendous advancement taking place when economic output was largely agrarian. Humans were able to grow more food than ever before as the use of the wheel, oxen, and plow were introduced. However, innovation in an agrarian economy led to a growing population (more food to feed more people) but never resulted in dramatically better living standards. As the concept of land ownership evolved, taxation on agricultural income led to civilizations with a small group of very wealthy people. Life was good if you happened to make your way into the inner circle of elites, but life for the masses was rough and nothing like what we enjoy today. It seems foreign to think about, but before the Industrial Revolution people largely made what they needed, on their farm, by hand.

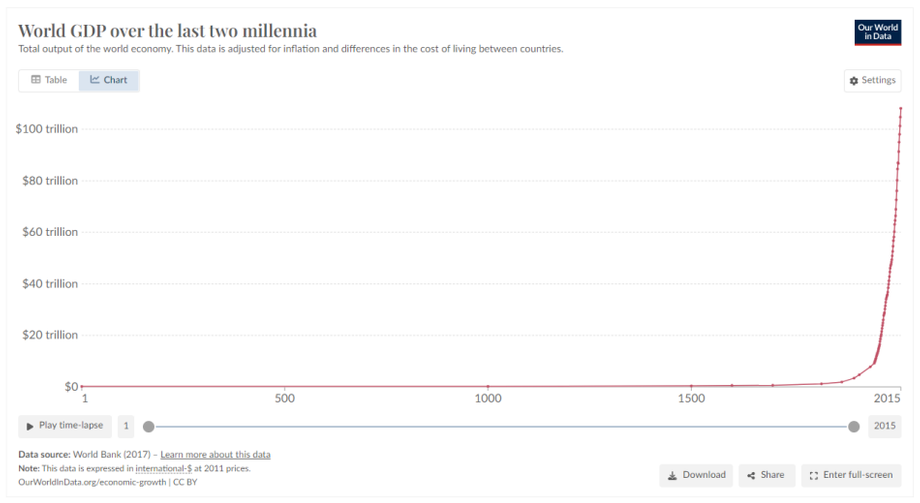

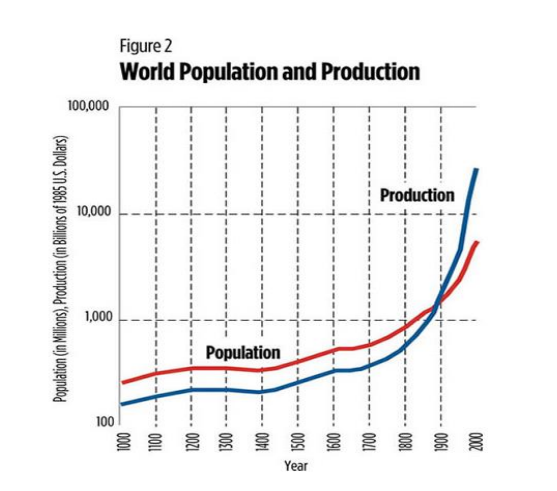

Production largely tracked population up until about 1800. Since then, production and population have accelerated with production drastically outpacing population. This crossover was the point of profound change. The Industrial Revolution saw people make machines that allowed them to make products significantly cheaper, faster, and of consistent quality. The spinning jenny, steam engine, electricity, light bulb, telegraph, telephone, internal combustion engine, automobile, and plow were all inventions unlocking the ability to produce like never before.

- Steam engines went from powering machines that spun yarn, to ships, and eventually locomotives as a nationwide transportation system was built.

- The concept of butchering pigs on conveyor belts eventually led to the assembly line used to mass produce cars.

- Eli Whitney’s cotton gin first made him famous but it was his use of interchangeable parts that revolutionized firearm production allowing him to produce mass quantities of muskets. This become a blueprint for building other goods with interchangeable parts.

This was the era of the tangible database. We learned how to create mechanical marvels that shared component parts and unlocked use cases across various industries.

Source: https://ourworldindata.org/what-is-economic-growth

Entrepreneurs were able to centralize labor, creating factories that specialized in the efficient production of standardized goods. For those that knew how to design, work with, and operate the machines, wages increased significantly. This allowed for the booming city to form, bringing in millions from rural life. Initially, working hours were long and conditions were poor. However, as learning curves accelerated output boomed and eventually led to the masses enjoying something they never had – disposable income and leisure time. It is no coincidence that numerous professional sports leagues and the movie industry formed during this time. Disposable income drove demand for other ancillary businesses like restaurants, retail stores, organized healthcare, and beauty services. In the span of a few hundred years much of humanity’s standard of living boomed and would have been unrecognizable to people of centuries past.

Source: https://www.minneapolisfed.org/article/2004/the-industrial-revolution-past-and-future

We often wonder if people were aware of the profound change taking place during this time. Another question to ponder, would we recognize if just as much profound change were occurring today? As previously mentioned, we’re now a society obsessed with the short-term. Ironically, this is most likely due to our incredible increase in living standards unlocking ample leisure time to consume more “information” than ever. We know it’s challenging to disconnect from routines. Although difficult, when stepping back and observing what’s taking place, we do believe we’re in the midst of massive transformation. Our prediction is that in a few decades we’ll look back at how the 2020’s were the beginning of a revolution, an Intelligence Revolution, that led to some of the most dramatic change to living standards since the Industrial Revolution.

Welcome to the Intelligence Revolution

What’s driving it?

AI – we’re literally making sand think - Computer chips derived from sand (silica) now power giant neural networks resulting in unimaginable results. If you had asked us five years ago if it would be possible to have a computer pass some of the toughest exams given in the fields of finance, law, & medicine we would have said - no chance. Or if that same machine could generate images of anything you could dream up in seconds – no way. Or be viewed as a threat by screenwriters and actors – absolutely not. But here we are.

The capability of AI will most likely surprise just about everyone as we transition from Moore’s Law to Huang’s Law. Moore’s Law, which governed much of technological advancement through recent history, said that the number of transistors on a computer chip doubles approximately every two years. This implies an approximate 32X increase in computing power over 10 years. Huang’s Law says that we will more than double computing power every two years through a combination of gains from accelerated computing, artificial intelligence, and data center scaling. What’s possible? If you track Nvidia’s GPU performance, it has increased 1,000X in 10 years implying a doubling every year. If you couple the GPU gains with the other factors of accelerated computing, deep learning, and data center scaling, Nvidia has produced a 1,000,000X increase in computing power over the past 10 years implying a doubling nearly every month! Huang predicts the same type of improvement over the next 10 years. “For nearly four decades Moore’s Law has been the governing dynamics of the computer industry, which in turn has impacted every industry. The exponential performance increase at constant cost and power has slowed. Yet, computing advance has gone to lightspeed. The warp drive engine is accelerated computing and the energy source is AI.” - Jensen Huang

Language as an operating system - As these digital brains ingest more and more information it has unlocked the ability to interact with them in simple terms. Knowing how to code used to be required in order to build things like web pages and apps. Some of our best entrepreneurs have turned these skills into billion and even trillion-dollar companies. Today, we’re seeing the first examples of anyone being able to build in the digital space by merely telling or even showing a sketch of what they want to create. The ability of these AI models to understand natural language is a profound breakthrough.

Renewable and abundant low-cost energy - Many of you have solar panels and some might even have battery systems to store energy during times when the sun isn’t shining. The cost of these systems has plummeted over the past couple of decades and solar is now the cheapest form of energy that can be added to the grid. What might not be well understood is that these renewable energy systems unlock the ability to produce abundant energy at costs approaching zero. There are no exploration costs needed to uncover new resources. There are no wells to continually drill. There are no pumping costs to bring fuels to the surface. There are no refining costs to turn raw material into finished goods. We’re simply capturing energy from our giant fusion reactor in the sky that shows up every day, always works, and never requires maintenance.

Space – Vehicles of the future are being built and tested that if successful, will see launch costs plummet while dramatically increasing payload. Exploration of space, building in space, mining the natural resources of space, and eventually living in space once sounded far-fetched but is quickly becoming probable. Countries, along with some of our most successful entrepreneurs, are committed to the development of a space economy as once dormant programs have been reinvigorated with life.

Engineering biology – it is said that engineering can be viewed as the antithesis of nature. We want engineered systems to work as intended, be reliable, and solve specific problems. Biology is often viewed as a marvel of Mother Nature – beautiful, amazing, and far from being understood by welldefined rules. However, this view is starting to change. We now have a toolkit that is allowing us to design, test, and refine biological systems without having to wait for the patient hand of evolution. This opens the door to scientific breakthroughs like curing diseases, increasing life expectancy, and designing more resilient, higher yielding, nutrient-rich crops.

How will life change?

Removing constraints - Humanity is literally on the cusp of being able to produce labor, abundant energy, explore the stars, cure disease, and deeply understand and design biological systems. The incredible “hockey stick” of exponential economic growth seems likely to continue leading to incredible wealth creation. The constraints of economic output are rapidly shrinking, unlocked by machines capable of assisting and eventually solving complex tasks. Some believe AI’s mastery of complex subjects like mathematics, chemistry, and physics is not far off into the future. This could lead to AI systems inventing new technologies. Put differently, Artificial Intelligence could be the last machine man needs to design because of its ability to design and build its own creations.

Where we live - With urban life well established and most of us long removed from an agrarian lifestyle, the shift of where people live may not be as dramatic as during the Industrial Revolution. However, the Intelligence Revolution unlocks perhaps the biggest change in living conditions of all, as man will have the ability to permanently live somewhere other than Earth. The model of an efficient city still resonates but having them floating in space or located on another planet will be profound.

Back to being human – people love to visit older parts of the world in awe of what humans once created. Beautiful art, amazing architecture, tightly-knit villages, wonderful food – creations that virtually everyone loves and connects with. Sadly, one of the largest drawbacks to our post-Industrial Revolution way of life just might be how much time we’ve had to sacrifice for work, largely giving up on our desire to be creative. At this point, we’re basically savants when it comes to standardized production. Just look at the numerous businesses producing the same goods. We’ve got hundreds of restaurants that specialize in pizza and burgers (albeit delicious), numerous manufacturers of clothes as long as you wear S, M, L, or XL, cars that are basically identical if you remove the badging, and houses that come in a handful of floorplans.

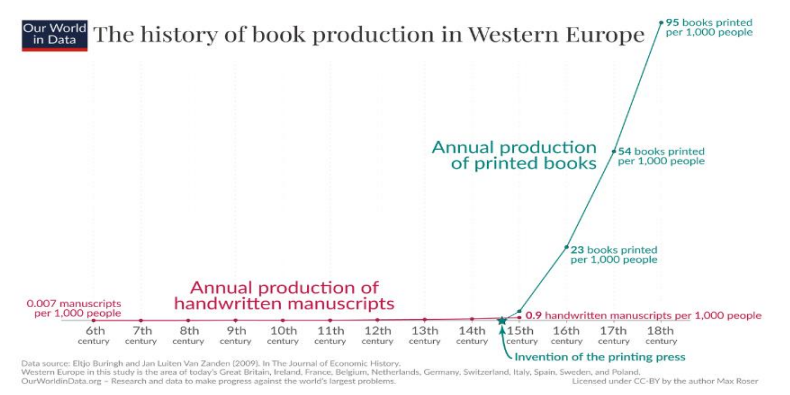

Think about how foreign our services would have seemed to someone before the Industrial Revolution. The concept of one day not working would have sounded absurd. “Retirement, what the heck is that”? Yet, as we’ve continued along this productivity boom, retirement has become commonplace and a goal for virtually everyone. There are 8,760 hours in a year. If you assume people sleep 7 hours per night, that leaves approximately 6,200 hours that people are awake. In 1870 Americans spent half their waking life at work! Today, this number is closer to one quarter. Merely continuing this trend takes us to a future where leisure time far outweighs work. The Intelligence Revolution offers the potential to spend the majority of our time connecting with people, creating items that inspire, all without sacrificing production.

Source: https://ourworldindata.org/working-hours

What could go wrong?

Being pessimistic almost always sounds smarter than being optimistic. We’re hardwired to view the unknown through a fearful lens. Some might say we’re not aware of the potential risks to an Intelligence Revolution. Trust us, we spend a great deal of time considering what could go wrong. However, when writing our commentary we believe we often serve as an optimistic balance to the abundance of daily fear. Nonetheless, let’s explore some of the concerns we view as valid.

What are people going to do? If machines start to handle the majority of work, what will everyone do for a living? We’re now hearing the concept of a Universal Basic Income being floated about. We believe it’s far too early to actually start something like this as we still have millions of unfilled jobs in our country. However, if the Intelligence Revolution unlocks a future where far fewer humans are needed to produce goods and services, we believe there is a significant misunderstanding. That future would be a lower cost future and one in which money buys significantly more. An unconstrained future led by Intelligence is more likely to result in a Universal Abundant Income as the costs of goods and services plummets. These machines would be the ultimate deflation machines.

Terminator – we think everyone has seen the movies. A futuristic world in which intelligent machines recognize humans are the problem to advancing society and choose to do away with our species. Some of the brightest minds in the field are warning about the need to make sure we get this human / machine alignment correct. If general and eventually supreme intelligence is achieved it would be nice to think we won’t spend our newfound leisure time running from robotic killing machines. Not sure if there’s much of a way to mitigate this risk other than requiring thought leaders in the field to continue to be open and transparent with what they’re building.

Today’s challenges – Do these ever change? Government debt, immigration, geopolitical conflict, elections, homelessness, drugs, education, fiat currency, decline of empires, etc. World War III could put a wrench in progress. So too could Mother Nature’s fury. Unfortunately, there isn’t much we can do about this. There’s inherent risk in being alive that cannot be removed or diversified away.

Parabolic productivity gains

We fully understand that calling out we’re in the midst of an Intelligence Revolution sounds outlandish and like science fiction but so did the view that machines would be able to pass some of our most difficult standardized tests, create enjoyable stories to read, astonishing pictures to see, and quality songs worth hearing. None of this sounded real just a few years ago. If you extrapolate the progress of AI, it doesn’t take long to get to a very unfamiliar place. The better question just might be, what won’t be possible?

In our opinion, the Intelligence Revolution has started. Initially, we’ll see the greatest impact in fields where vast amounts of written information exists. Eventually, this intelligence will spread beyond the digital realm as advancements in robotics allow these digital brains to enter and interact with the physical world. We don’t envision it taking long for the amount of digital compute to outnumber biologic compute. Several years ago we wrote about the incredible innovation taking place, leading us to call this decade the Roaring 2.0’s. The progress has even surprised us. At this point we believe the innovation is driving us towards something much bigger – hence our call for a revolution. We look forward to seeing that first humanoid robot working alongside people on a factory floor, that first ship that lands on the moon with enough payload to start construction of a permanent base, and that first person that can once again list “Explorer” as their occupation as humanity moves out amongst the stars. It is an amazing time to be alive and witness this profound change.

FORECASTS

This is the section of the annual letter where we discuss forecasts made in the past and discuss the bullets on the opening page of this annual letter. As we do every year, we remind ourselves it’s a foolish section where we think we can actually make forecasts for the future! We enjoy using “What If” in our thought process as it allows for outside-the-box thinking and challenges our (and your) assumptions. It also allows us to think beyond the current “news cycle” forecasting that permeates much of the financial press. As a reminder, these forecasts are our thoughts as of the writing of this annual letter in mid to late-December. Markets are dynamic and ever-changing. When change occurs, so too must our thoughts to adapt to the then current investment environment.

We reiterate, our portfolios are managed substantially from the bottom up. This means we look at individual investments themselves and the long-term value they represent, knowing that quality companies at the right price represent value. With this reminder out of the way, let us review our forecasts from 2023’s annual letter and make some new and bold (and perhaps futile given our longterm perspective) forecasts for 2024. For 2023 we had a mixed record again, getting many correct (7 1/2) and some wrong (2 1/2). Fortunately, the main message forecasts were mostly on the positive side of the ledger.

The Economy:

Last year we forecast that by the 3rd quarter of 2023 the US economy will continue to show a yearover-year increase and eclipse $26.50 trillion. This was a significant departure from most of Wall Street which was forecasting that higher interest rates would slow the economy into a recession and see economic output shrink. We believed that re-shoring of industry, a robust service economy, job openings greater than the number of unemployed, strong consumer and corporate balance sheets, and disruptive technology driving productivity enhancement would anchor economic output during 2023. To some extent, mostly all of these items helped in 2023. We also said that while the economy may slow due to higher interest rates and even experience a quarter or two of stagnation, we still believed it will be higher on a year-over-year basis. In actuality, no quarters suffered a decline in GDP. Quite the contrary as we saw 5 consecutive quarters of growth. While we underestimated the growth of GDP and the strength of the consumer in the face of higher interest rates, we were correct that there would not be a decline. The Bureau of Economic analysis detailed that the first few quarters of the year were indeed slow, but that by the end of the 3rd quarter the real growth rate had increased to 4.9% and GDP had grown to $27.61 Trillion. Full Point on the Economy!

For 2024 we forecast the US economy will continue to show a year-over-year increase and eclipse $28.5 Trillion. This is a slower rate of increase than the third quarter of 2023, but nevertheless, a call for continued growth. Our view remains unlike much of Wall Street that is forecasting a declining economy that will force the Federal Reserve into “rescue mode” and lower interest rates prior to the election (more on that in the interest rate section). Many of the same influences that we thought would keep the economy growing last year will continue. As we’re in the midst of the “Intelligence Revolution”, COVID-19 impacts have largely been worked through, and interest rates have stabilized, we believe there is a core economy that will continue to grow as the population of our country continues to grow. A key premise of economics is that as populations grow, so does the economy that it necessitates. Later this century we may have to look at the growth assumptions that a decreasing population implies, but at the moment, that is still at least a decade away. Whatever your views on the immigration issues, there is no denying that migration is countering the low birth rate we have and is keeping our population growing. If you would like to chat about this topic (demographics and its impact on economics) we welcome a chat on the phone. Bottom line is we forecast a sluggish economy but no recession.

Inflation:

Last year we saw the wage / price spiral being kept in check by technology driven productivity enhancements and job openings across many of the highest employment sectors being met by a continued wave of immigration. These factors should mean we have indeed seen “peak inflation” and possibly see the rate approach 5% or lower sometime during 2023. The November reading on inflation came in at 3.1% - Full Point here.

Last year we reminded investors that “it is easy to forget the regularly occurring, sub 2% inflation rates seen since the Great Recession of 2008 / 2009 are not normal”. Since 1948, the average inflation rate is approximately 3.5%. Credit where credit is due, the historic hiking cycle by the Federal Reserve has potentially kept an accelerating, inflationary spiral from taking hold. That spiral would have been caused by the massive increase in money supply that occurred during the COVID 19 pandemic. While money supply has started to contract it is still well above the long-term trendline as it continues to work its way through the economy. Have we reached the end of price increases being caused by “transitory” supply chain issues? Will inflation trend back to below the long-term average of 3.5% as it finds the level the economy can support? We suppose it’s possible.

An election year may not see any extra fiscal stimulus, and in fact, we may see posturing about a reduction in spending rather than growth.The Federal Reserve has signaled that they truly want the impact of their interest rate hikes to play out in “the numbers” before making any moves. The Fed certainly wants to avoid the embarrassment of having to raise rates shortly after making a cut, so we believe hikes are on hold and cuts remain off into the future. If inflation were to pop back up a bit, the Fed still has its balance sheet that it can use to slow the economy without raising the discount rate. This makes for a year where the economy dictates inflation rather than outside influences. With our outlook for sluggish economic growth but no recession, excess money supply continuing to work through the system, and our interest rate forecast below, we forecast inflation to be in the range of 3.0% to 3.5% during 2024.

Short-term rates:

For 2023 our forecast was “we have no reason to believe that the Fed will not be resolute in their battle and continue to raise the Federal Funds rate to at least their target of 5%. Further, as a 5% Federal Funds rate is not much above the long-term historic average (unlike Volker’s rate hikes of the early 1980’s) we would not be surprised to see it stay above 5% through the end of the year. If we are wrong, it may be because the rate is higher than 5%, but we are not forecasting it to be eased below 5%.” The Federal Funds rate is currently 5.25% - 5.5% with no decreases – Full point

With unemployment remaining low and inflation trending towards 3%, the Fed has signaled that they’re possibly done with rate hikes. Wall Street’s focus has now shifted from the potential pain caused by the hikes to the potential benefits of what future rate cuts could bring. A potential problem we see is a generation of market participants unaware that ultra-low rates were the exception and not the rule. Since 1954, the average fed funds rate has been 4.6%, not that much lower than it is today. We are firm believers that there needs to be an economic cost of capital. It forces users of borrowed money to do things that make economic sense and does not reward those who over borrow or wastefully expend capital.

Given our beliefs that the Fed wants to see more data that hikes are working and we will continue to see economic growth, we feel the Fed has time to be patient. Further, considering we’re in an election year, we also believe the Fed will not want to be perceived as being political and lean towards not wanting to cut. Therefore, the first time we see a cut back towards the long-run average would not be until the December 13th meeting. Keep in mind there are always wildcards and “Black Swan” events that could come into play. A major fight over the budget that leads to an extended government shutdown might be one of those. At the moment, this would probably be more for headline grabbing and political grandstanding, but in the end still see the government remain open. As a rather contrarian call, our forecast for 2024 is no change in the Fed Funds rate.

Long-term rates:

For 2023, we forecasted the yield on the 10-year US Treasury would stay below the Fed Funds rate but the yield curve will flatten and see the rate approach 5% by year-end. For over 10 months of the year we were spot on with this forecast. The 10-year yield was 3.88% at the start of 2023 and had slowly trended to 4.997% on October 23 rd. Then the Fed signaled that rate hikes were indeed on pause (if not completely done) and markets started to anticipate rate cuts in 2024. At the December meeting they even showed “Dot Plots” with lower rates in the future. The markets anticipated and discounted those expected cuts by taking the 10-year yield to 3.86% on December 29th. We were close but cannot take a point for this forecast.

For 2024 our forecast has a couple of variables playing out that impact the velocity of money as well as the supply of money. These variables may have a greater impact on long-term rates when compared to what the Fed decides to do with the discount rate.

To state the obvious, we have an incredible demand for money being fueled by our government’s deficit spending. Fiscal policy just might be one of the great debates of 2024. We already have numerous voices asking if we will ever tame the unbalanced spending. 2023 saw $1.7 trillion added to our national debt. We now have $34 trillion dollars outstanding which is an alarming 123% of GDP (keep in mind this does not include unfunded obligations like Medicare and Social Security). For some perspective, national debt was $16.7 trillion in 2013 and only $6.8 trillion in 2003. As if this ballooning debt wasn’t bad enough, we must now couple this with a much higher cost of borrowing. We wrote a couple of years ago that we hoped the government would issue 50 or even 100 year debt and lock in those historically low rates. Unfortunately, it didn’t happen. We’ll now see higher rates increase borrowing costs, eating into the annual government receipts, making the idea of a balanced budget seem more like a dream than a goal.

Thinking long-term, the only realistic way to reduce the negative impact caused by this higher-cost, excessive spending is to grow the economy while simultaneously reducing government spending. While we agree that government employment is probably like pre-Musk Twitter, (they’ve reduced their workforce by approximately 80% while the product hasn’t missed a beat) we also believe that a wholesale reduction of government employees could be too much too quickly. We prefer a gradual reduction in the size of government. Without a disciplined approach to fiscal policy, history has shown the only other ways of dealing with massive debt are hyper-inflation (paying the debt with worthless money) or a change of currency (repudiation of debt or a change in government). While those eventualities have been the subject of historic revolutionary times and the topic of science fiction novels, we worry that as the 2030’s and 2040’s draw closer, something dramatic may be needed.

For 2024 we believe the demand of capital by the federal government and the refinancing of trillions of dollars of debt at higher interest rates will have a dampening effect on capital available for future growth. Fortunately, the impacts of the “Intelligence Revolution” may lessen the need for capital as significant productivity gains are had and some of the brightest, most disruptive companies do not require excessive amounts of capital infusions. Historically, a long-term cost of capital in the range of 4 - 5% has been neutral, leading to sound economic rationalization from borrowers. With our forecast that the Fed keeps short-term rates unchanged for 2024 (at least until after the election) we see the 10-year yield drifting up towards 4.5% by year-end. As importantly, we do not see it drifting back towards the unhealthy, accommodative levels of a few years ago.

Stock Market:

To reiterate, we believe successful investing requires a multi-year time horizon. However, we will hazard a forecast for every year. We believe that owning assets, such as shares of great companies, is the best way to create wealth on a long-term basis.

The recovery we were looking for in the second half of 2022 did not occur until later in 2023. Solid earnings growth drove appreciation with the S&P 500 well above 4,000 by year-end (closed 2023 at 4,769). As we expected, the fear the market entered the year with was unjustified and many of the positives we cited as able to drive the market higher did indeed come to pass – Full Point.

For 2024, if we are correct that the Fed is able to keep short-term rates higher than many expect, there could be some disappointment. If markets don’t get the rate cuts they were anticipating it wouldn’t surprise us to see a knee-jerk reaction, unwinding some of the advance seen in late 2023. The “Santa Clause Rally” of 2023 saw the market multiple expand to nearly 19.5 times 2024 EPS expectations. In our opinion, any declines in 2024 should be treated as opportunities to invest in the ownership of great corporations. Wall Street has a saying that “the easy trade is generally the wrong trade.” In 2023, the easy trade was to buy short-term bonds for a 5% yield. Those that did missed out on significant gains from stocks in 2023. Naturally, we would like the market to pull back to give us another great entry point but another Wall Street adage comes to mind, “the market never does what you want it to do”. With the Intelligence Revolution gathering steam and going parabolic, the wealth creation opportunity over the long-run could be remarkable.

Valuation tools like the Fed Model still show stocks as attractive relative to bonds. Equity market multiples seem to be at attractive to discounted levels based on fundamentals. However, with the rise in interest rates we now have an alternative to stocks. The Baby Boom generation still controls a great deal of wealth. As they’re now in or entering their “Distribution” stage of life, they tend to favor less volatile returns as they’re living off their “investment paychecks”. As long as yields from fixed income remain attractive it does away with the TINA (there is no alternative) narrative that led to much multiple expansion. Our belief that interest rates remain normal and in-line with historic averages may translate into a headwind for any type of multiple expansion (in fact we could see some contraction).

For 2024 we feel that earnings will continue to increase and therefore so too will the fundamental value of corporations. Stock buybacks will be announced by those corporations that do not have to refinance debt and dividend increases will return to historic rates of growth led by better earnings. There should be increasing investment in the “Intelligence Revolution” as companies realize that technology is disruptive and will either embrace it or get left behind. Analyst estimates currently predict earnings growth of 11.7% ($243.54 for 2024 vs $217.99 for 2023) even though many also predict recessionary forces acting on the economy in 2024. As always, there are many factors at play. On the potentially negative side we have no interest rate cuts in the middle of the year coupled with continued political dissention both domestically and abroad. On the potentially positive side we have continuing productivity enhancements and a still growing economy. This leads to a market that may be range bound based on its historic earnings multiple. For 2024, we apply a P/E multiple of 17 – 19 times forward earnings estimates for 2025 ($274.17) which translates to 4,700 – 5,200 on the S&P 500. This is where we entered the year on the low-end and approximately 9% higher on the high-end. We see 2024 as a year where stock returns follow earnings growth.

Oil:

For 2023, we thought oil prices would be driven more by geopolitical pressures than by actual demand. We held that OPEC could become swing producers again and most likely limit production to maintain the average $80 price for the year. The WTI spot price average came in at $75.93 per barrel in the first quarter of 2023, $73.54 per barrel in the second quarter, $82.25 per barrel in the third quarter, and $78.55 per barrel in the fourth quarter – Full Point.

Looking forward, we see OPEC still being the controller of oil prices. Even with Angola leaving the organization, it still could control marginal output on a global scale. Short-term disruptions, like routing away from the Suez Canal, will not deter OPEC from keeping the price high enough to fund Saudi Arabia’s diversification efforts away from hydrocarbons as the driver of their economy. They are building projects for the future (alternative energy, The Line, increased infrastructure) and reducing regulation to increase exports from 16% of their economy to 50% by 2030. The investment needed to make this happen requires oil revenue and they will do what it takes to set a floor under oil prices of $70 - $80 a barrel. They would be more than happy to see events like wars, politics, and supply disruptions take the price higher for periods of time. However, they walk a fine line between making the price too high and driving industry adoption even faster towards alternative sources of energy. For 2024, we see oil prices maintaining a range of $70 - $100 a barrel and averaging in the $80’s for the year.

Commercial Real Estate:

With our belief that long-term interest rates would be approaching 5% in 2023, we thought this would be a continuing headwind for REIT valuations. For 2023, we forecasted a slight positive total return from REITs and would position portfolios into the sub-sectors that still have a fundamental need in the economy – manufactured housing, industrial warehouses, data centers, and health care (but not hospitals). For most of 2023 this forecast was spot on. With the drop in interest rates the FTSE NAREIT All Equity Index saw a strong finish to 2023 being up 11.48% - Full Point.

As we have often maintained, real estate is a long-lived asset with leases that will reflect economic forces over time. As inflation and interest rates rise, renewals on rents will reflect that, but it will be years and years before those changes work their way through the marketplace. In the meantime, cash flows continue. With liabilities on the properties paired off to those cash flows, the staying power of real estate can be a welcome piece to a portfolio. The valuations of those cash flows over the shortterm (even year-to-year) becomes the volatility seen in the prices of REITs. When compared to alternative, cash flow generating investments, the current price can be impacted. However, over the next ten years we would continue to prefer owning quality REITs with rising income streams as opposed to a fixed coupon from the 10-year treasury. Share prices should appreciate once value-added projects take shape and rents are increased.

For 2024, we forecast a nice positive total return from REITs with stabilized interest rates. Similar to last year, we would position portfolios into the sub-sectors that still have a fundamental need in the economy – manufactured housing, industrial warehouses, data centers, and health care (but not hospitals). Overall, we see the FTSE NAREIT All REIT total return coming in at 10% or higher in 2024.

Residential Real Estate:

Last year we thought that rising mortgage rates could make home affordability even worse. For the first time since the over leveraged real estate bubble of 2007 – 2009, the S&P Case-Shiller index would decline year over year. It did not – and in fact is up 5.8% through October - No Point.

Migration away from highly taxed, high-priced states continues. While work from home allows many people to migrate to other parts of the country, a new factor has led to many staying put – their existing low-rate mortgage. Why would someone sell a house with a 2% mortgage to trade into a home with a 7% mortgage? In 2023, the velocity of home sales declined creating a supply shortage in many areas. Existing home sales, building permits, and housing starts initially declined during 2023 but as mortgage rates declined (back below 7% on a 30-year fixed) towards year-end, building permits and housing starts once again climbed in November. There is certainly pent-up housing demand from a generation that has been renting and wants a piece of the “American Dream”.

We have often maintained that home ownership fixes one of the major expenses in your life – the cost of housing. Your mortgage payment is fixed while rent payments increase over time. If you can stay in a home for ten years or longer, your mortgage payment should be substantially below comparable rent. However, the costs associated with transacting real estate make owning a home versus renting questionable if it is only for a few years of ownership. The affordability of homes based on the median family income and the median home price continues to get worse. In the west, 38.9% of a family’s income would be required to make the principal and interest payments now. According to the National Association of Realtors, to even qualify for a conventional loan your income would have to be $168,144. In the Midwest the numbers are better with 20.3% of income and $78,624 of income.

Where your family resides, job opportunities, and a strong economy are still the leading motivators of location demand. We are however seeing more and more migration away from high-cost areas. We see the migration away from high tax, high-cost locations continuing. Until the demographics of the country start to reflect a shift in the population to one that is declining, we see the demand pressure for housing continuing to drive the Case Shiller Index higher. For 2024, we see the magnitude of that increase as muted and see it rising less than 5%.

Fun Forecasts 2023

We have put easy and hard forecasts in this section. For 2023, we wanted these forecasts to be more challenging and really put some concrete predictions out there.

The first fun forecast was about Disney. We predicted that “Bob Iger’s return as CEO is being done as a way for him to engineer one final deal. We predict Iger will focus on a mega merger / acquisition with a company looking to invest heavily into what is quite possibly the greatest film / television content portfolio of all-time. Iger has been the mastermind behind four significant deals while he ran Disney: Marvel, Lucas, Pixar, and 20th Century Fox. At this point, we don’t believe they have a content hole to fill. With their valuable franchises, library of characters, dominance in sports, and loyal fans, we believe a tech-centric partner could take their experiences to a whole-new level.” Iger has certainly been righting the ship at Disney. His focus remains on achieving profitability at Disney +, tying creator compensation to the content’s success, investing in parks and experiences, and shoring up the content pipeline. Recent deals include their purchase of the 33% stake of Hulu from Comcast with numerous other possibilities constantly in the headlines. While many are hoping for a takeover of Disney by the likes of a company such as Apple, Iger is indeed focusing on the monetization of their content portfolio both now and into the future. We will take a point here.

Our second fun forecast was about Twitter. “Twitter is now moving at Elon-speed and we predict they will roll out new features at a pace never seen when it was a public company – video, audio, payments, etc. The transparency they will bring to the platform will make Twitter a leader when it comes to restoring trust in independent, investigative journalism.” We believed the transformation would be so dramatic that talks of an IPO would be happening by year-end. Certainly much transformation has occurred and continues to take place. They’ve opened their code for transparency and public scrutiny, taken vigorous actions to allow free speech (even at the expense of losing revenue from some advertisers), and only need approval from a few more states to allow payments on the platform. We haven’t heard any IPO talk yet, but much of the rest is happening. We will take half a point here.

Fun Forecasts 2024

First, we will do a couple of forecasts for just 2024 – more for keeping score than the real purpose of the “Fun” forecasts. For 2024 we forecast a notable marriage taking place in the entertainment industry. LOL, not two stars, but rather two companies getting hitched. Consolidation of content and streaming services needs to happen – it is too fragmented to continue and be profitable.

AGI (Artificial General Intelligence) will be recognized as being here and worries will shift towards ASI (Artificial Super Intelligence). 2024 will most likely see incredible improvement in AI across various industries. As AI’s capabilities continue to grow we believe many will truly begin to fear it, thinking we’re at the dawn of seeing Skynet created by Cyberdyne Systems. We envision greater calls for the need to pass meaningful regulation but believe the speed at which the field continues to evolve will largely make the attempts meaningless. We believe that ASI will be on the scene before regulations will be passed. We like to think of AGI as when a task can be completed as if it were done by a competent person. We think of ASI as when AI is capable of creating things by itself, superior to our most intelligent humans.

Beyond 2024 – 5 years out!

The real purpose of the “Fun Forecasts” is to have us think outside the box, try and remove the recency bias we all suffer from, and look beyond much of today’s negative outlook. Why are we always dreading the “Black Swan” events? Why can’t we anticipate “White Swan” occurrences? Many of our annual fun forecasts in the past have not been right in that year, but did come to pass in following years. Someone once said, “We over-estimate what we can accomplish in one year and under-estimate what we can accomplish in 5 years” Let’s think 5 years (and longer).

A working quantum computer will become reality – facilitating a jump to ASI

Current computing is done one thing at a time – sometimes with amazingly fast results. Quantum Computing allows a computer to work on multiple things simultaneously. This will translate into huge jumps in computing power and possibly be a driver of AI’s evolution from general to super intelligence.

We will break ground on a permanent moon base

A multi-planet, multi-galaxy species has to start with baby steps off of Earth. Reusable rockets, vastly larger payloads that will facilitate off-world activities like manufacturing and mining, and economies of scale will make it all possible.

Blake will enter his Tesla into a robo-fleet and earn money from it

Tesla’s Autopilot and Full Self Driving software is already showing that it is safer than humans in making driving decisions. As regulators review the data and consumers become more comfortable with the idea of driverless vehicles, we believe advancements in autonomous driving will change the economics of automobile ownership dramatically. With renewables producing electricity at a fraction of the cost, electric vehicles will be the most economic method of transportation well before many of the state mandates come to pass. Autonomous driving will make the cost of transportation so low that it will be more economical to catch a ride in a robo-taxi than to own a vehicle.

CONCLUSION

We will always strive to cull through information, ferret out the important from the unimportant, and take short-term emotions out of the long-term investment process. Our goal is to help our investors achieve their financial independence and the freedom to focus on what they want to do in life and not what they have to do. As always, we welcome your feedback and would love to talk about these and other topics that may be important to you. We thank you for your continued confidence and the opportunity to manage your investments. We take very seriously our responsibility. Montecito Investment Portfolio’s Mission: To provide diversified, disciplined long term investment solutions, service and guidance to help our clients achieve, and maintain, their “Financial Independence”.

Blake Todd, CWS |

Jarrett Perez, CFA |

| Senior Vice President, Financial Advisor, Portfolio Manager | Vice President, Financial Advisor, Portfolio Manager |

| btodd@dadco.com | jperez@dadco.com |

Disclaimers

This Annual letter expresses the personal views of the author and Montecito Investment Portfolios on the current and future economic and investment landscape, at this date. It is subject to change and is not necessarily the opinion of D.A. Davidson & Co.

The information contained in this presentation has been taken from trade and statistical services and other source, which we believe to be reliable. We do not guarantee that this information is accurate or complete and it should not be relied upon as such.

This presentation is for informational and illustrative purposes only, and is not intended to meet the objectives or suitability requirements of any specific individual or account. An investor should assess his/her own investment needs based on his/her own financial circumstances and investment objectives.

The forecast, projections, or other information generated by the author regarding the likelihood of various future outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results.

Neither this presentation, nor any chart or graphs within this presentation may be used, in or of themselves, to constitute investment advice. They are for informational and educational purposes only

There are risks inherent in any investment and there is no assurance that any money manager, asset class, style or index will provide positive performance over time. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Real estate investments may be subject to a higher degree of market risk because of concentration in a specific industry, sector or geographical sector. Real estate investments may be subject to risks including but not limited to declines in the value of real estate, risks related to general and economic conditions, changes in the value of the underlying property owned by the trust and defaults by borrower.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ.

The Standard & Poor’s 500 Index is a capitalization weighted index comprised of 500 widely-held stocks on US stock exchanges. Companies included in the index are selected by the S&P Index Committee, a team of analysts & economists at Standard & Poor’s.

S&P 500 Total Return Index is a measure of the price movement of The Standard & Poor’s 500 index and including the dividends paid by the companies in the index.

S&P Case Shiller Index – a group of indexes that tracks changes in home prices throughout the United States. CaseShiller produces indexes representing certain metropolitan statistical areas as well as a national index.

GDP – the monetary value of all the finished goods & services produced within a country’s borders in a specific time period.

The MSCI US REIT Total Return Index is an index that broadly represents the price and income movement of the equity REIT universe in the United States. The Index represents approximately 85% of the US REIT universe.

The Barclay’s Aggregate Bond Index – includes government securities, mortgage-backed securities, asset-backed securities and corporate securities to simulate the universe of bonds in the market. The maturities of the bonds in the index are more than one year.

P/E Ratio is a valuation ratio of the company’s current share price compared to its per-share earnings.

Past Annual letters are available by request and available on our website at: